arizona solar tax credit 2019

Renewable Energy Production Tax Credit. However unlike the federal governments tax credit incentive Arizona tax credits have a limit.

Tangible Personal Property State Tangible Personal Property Taxes

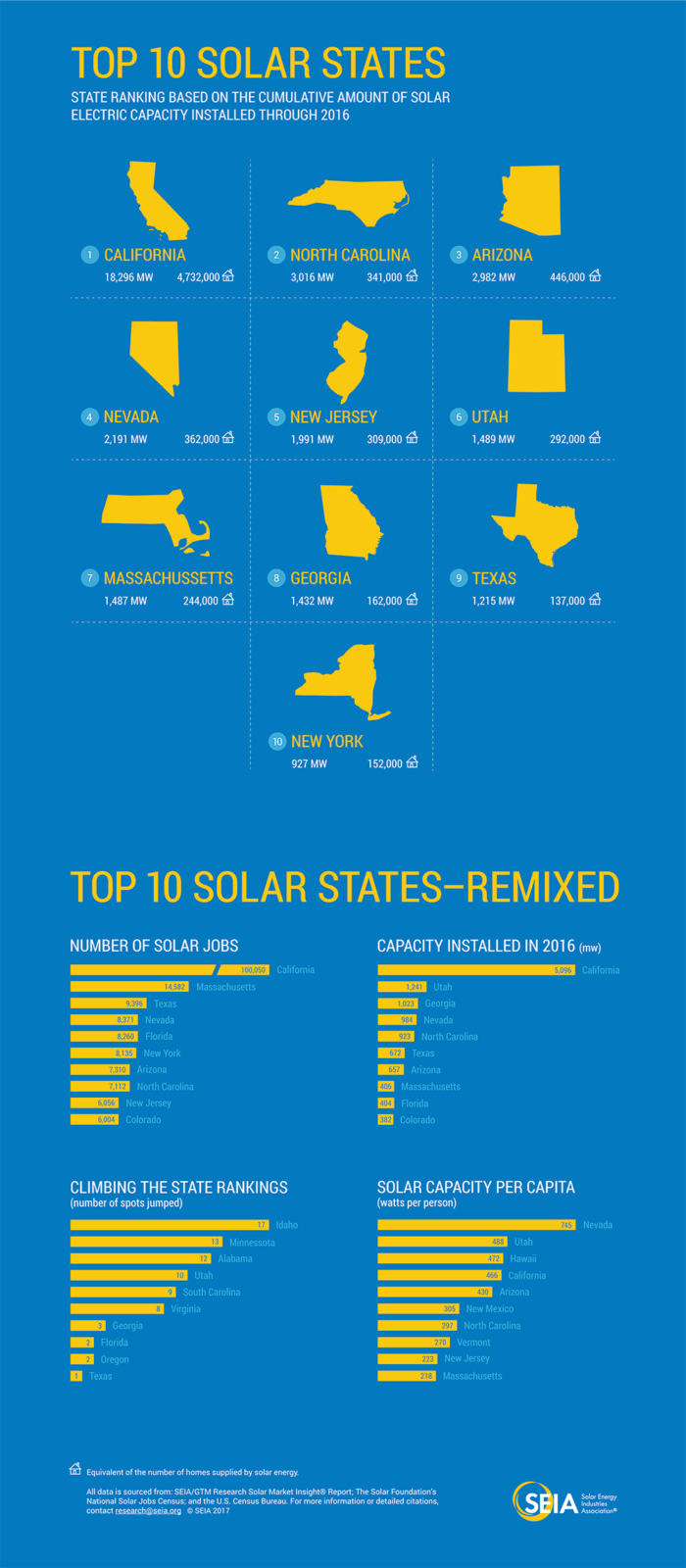

Each state has its own renewable energy incentive programs.

. With the investment tax credit ITC now referred to as the Residential Clean Energy Credit for residential systems you. The federal solar tax credit. Arizona solar tax credit.

Find Details Online For Arizona. Every resident in Arizona who installs solar panels gets a state tax credit of 25 of the total system cost up to 1000 to be used toward State income taxes. Check Out the Latest Info.

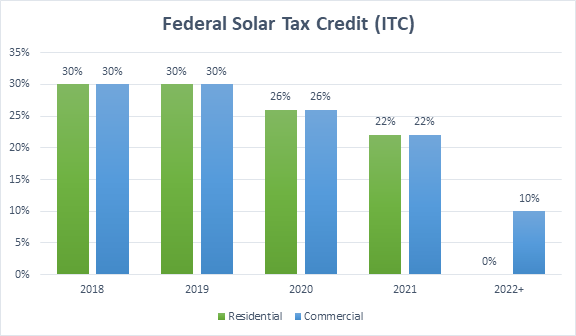

Content updated daily for arizona solar tax credit. Arizona alone has dozens of financial incentives rebate and loan programs for both. Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit.

Compare 1000s Of Reviews Ratings From Actual Customers. Arizona has the Arizona Solar Tax Credit. Ad Get 2022 Solar Company Quotes Information.

An individual or corporate income tax credit is available for taxpayers who own a qualified energy generator that first produces electricity before Jan. To claim this credit you must also complete Arizona Form. This is claimed on Arizona Form 310 Credit for Solar Energy Devices.

Here are the specifics. Arizona Solar Tax Credit 2019. The 30 tax credit applies as long as the home solar system is installed by December 31.

Browse Our Collection and Pick the Best Offers. The federal solar tax credit gives you a dollar-for-dollar reduction against your federal income tax. Ad Arizona solar tax credit 2019.

Arizona offers state solar tax credits -- 25 of the total system cost up to 1000. Arizona law provides a solar energy credit for buying and installing a solar energy device at 25 25 of the cost including installation or 1000 whichever is less. Tax Credit Reduction Timeline.

Dont forget about federal solar incentives. Ad Looking for arizona solar tax credit. AZ Form 310 for.

Income tax credits are equal to 30 or 35 of the investment amount. IRS Form 5695 for 2019. The 25 state solar tax.

It is a 25 tax credit on product and installation for both 2020 through 2023. But in order to qualify for that. Whos The Top Solar Company.

1 Best answer. June 6 2019 1029 AM. The Arizona Commerce Authority ACA administers the Qualified Small Business Capital Investment program.

The 26 federal solar tax credit is available for purchased home solar systems installed by December 31 2022. IRS Form 5695 for 2020. This means that in 2017 you can still get a major discounted price for your.

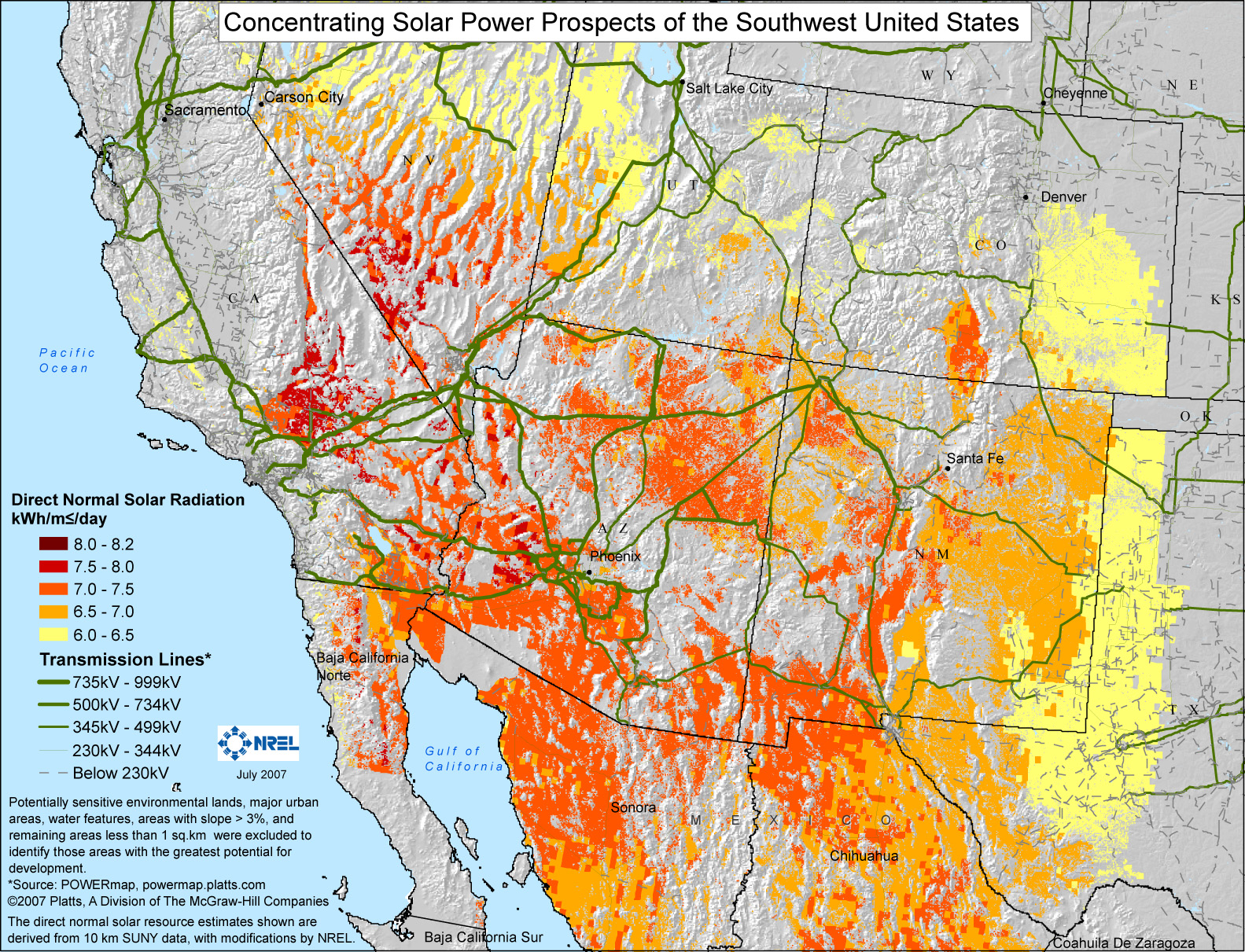

Information Administration shows that the state accounted for nearly 45 of. 2 According to our market research and data from. In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was.

Arizonas Tax Incentives and Solar Rebate Programs. The Arizona income tax credit for solar panels is 25 of your systems installed costs or 1000 whichever amount is less. You can only claim up to 1000 per calendar year on your state taxes.

Fortunately the Geothermal Tax Credit allows homeowners to apply their tax credit over multiple years. These are the solar rebates and solar tax credits currently available in Arizona according to the Database of State Incentives for Renewable Energy website. The tax credit remains at 30 percent of the cost of the system.

As a credit you take the amount directly off your tax payment rather than as a deduction from your taxable. The Federal solar tax credit allows homeowners to reduce 26 of the total costs related to their solar installation from what they owe on their federal taxes due.

The Federal Solar Tax Credit Guide Solaris

U S Energy Information Administration Eia Independent Statistics And Analysis

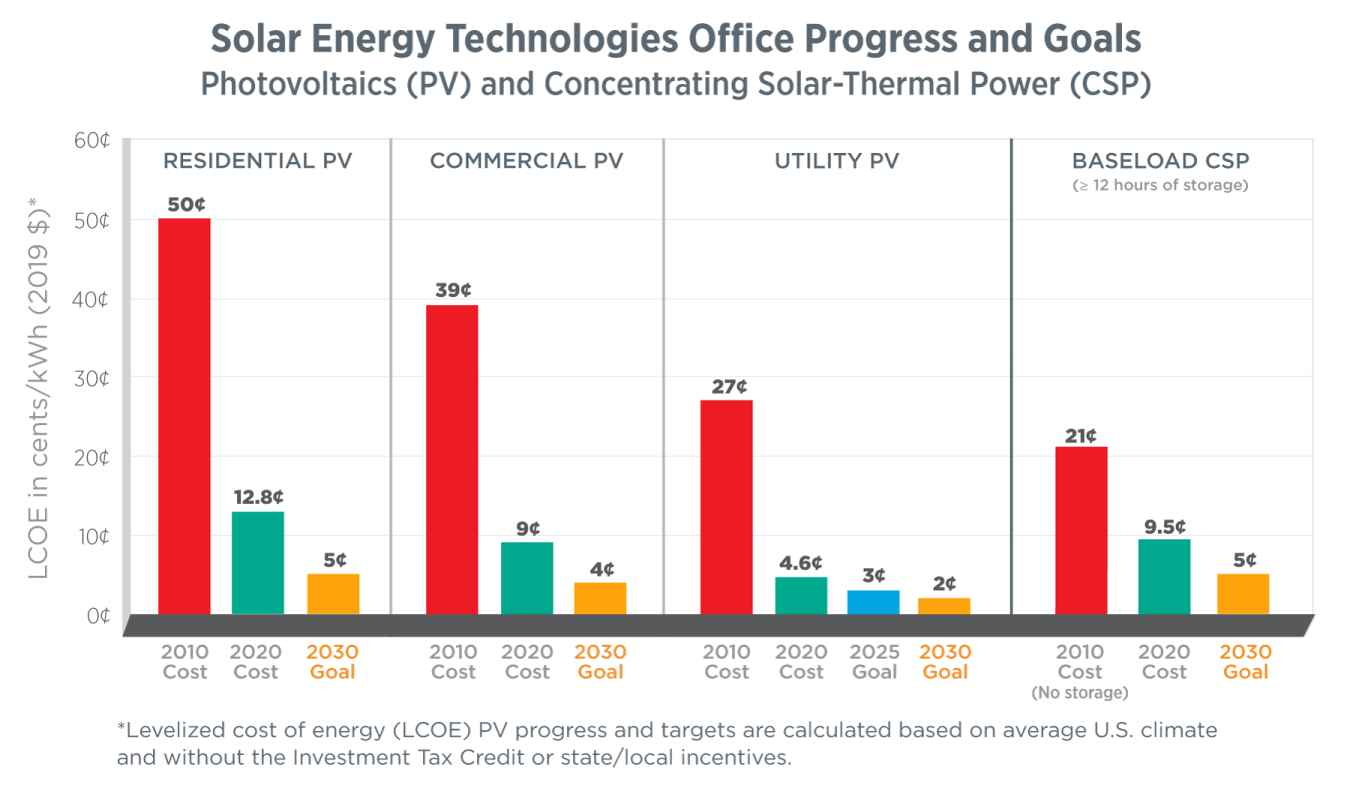

2030 Solar Cost Targets Department Of Energy

What Happened When I Bought A Home With Sunrun Solar Panels

How The Solar Tax Credit Extension Will Affect New Solar Customers Through 2019

How Community Development Tax Incentives Have Benefited Primary States Nevada Novogradac

U S Energy Information Administration Eia Independent Statistics And Analysis

U S Energy Information Administration Eia Independent Statistics And Analysis

Titan Solar Power Get Your Power From The Sun

How Much Do Solar Panels Cost 2022

Solar Tax Credit 2022 Incentives For Solar Panel Installations

I Am Not Claiming A Solar Credit But Keep Receiving An Error On My Az Form 310 Asking For The Address Of Where I Installed Solar Energy Device How Do I Get

Why The Solar Tax Credit Extension Is A Big Deal In 2020 Energysage

Solar Panels Are A Pain To Recycle These Companies Are Trying To Fix That Mit Technology Review

How Does Your State Make Electricity The New York Times

Tesla Solar Is Basically Free Evannex Aftermarket Tesla Accessories

Solar Tax Credit 2019 Solar Tax Incentives For Arizona In 2019 Youtube

Residential And Commercial Itc Factsheets Department Of Energy